Commercial Equipment Loans

Equipment Financing

As technology moves forward faster and faster, the equipment you use in your production process may become obsolete quicker than you think, leaving you at a disadvantage. Get set up with a Sunwest Bank equipment loan, update existing equipment, or invest in all new equipment. Keep your tech up to date to increase efficiency, attract top talent, and stay ahead of the curve.

Get Started Today!

Flexible Financing for Essential Equipment

With loans and terms matched to your equipment’s lifespan, Sunwest Bank simplifies securing equipment financing. Our experienced team understands the nuances of funding equipment purchases for manufacturing, transportation, healthcare, agriculture, etc. We listen to your business needs and collaborate to structure a loan that optimizes your budget and cash flow.

While interest rates and down payments vary, our equipment financing rates are competitive. We offer variable and fixed options rates for maximum flexibility. With a streamlined underwriting process, we can help you secure financing quickly to seize time-sensitive equipment deals.

An equipment loan enables you to:

- Acquire new or used equipment – Purchase essential or replace outdated assets to gain a competitive advantage. We finance new and used equipment to align with your budget.

- Consolidate equipment debt – If you have existing loans through multiple lenders, consolidate them into one monthly payment at a better rate.

- Manage equipment cash flow – Structure monthly payments that fit your budget and cash flow needs.

- Preserve working capital – Put equipment purchases on a loan instead of tapping your working capital. Conserve cash flow for other business needs.

- Build business credit – Responsibly financing equipment can help build your credit profile and improve access to future capital.

- Claim tax benefits – Potential tax deductions on equipment loan interest payments improve your bottom line.

Whether you need an industrial tractor, medical lasers, semiconductor manufacturing equipment, or anything in between, we have the expertise and equipment financing capacity to help make it happen.

SBA and Conventional Business Equipment Financing

Sunwest Bank offers both SBA and conventional equipment financing options. Our small business equipment loans group guides loan programs like the SBA 504 and SBA 7(a) designed for equipment acquisitions. With longer terms and lower down payments, SBA equipment loans offer affordable financing for smaller businesses. We also offer equipment financing through our conventional commercial lending platform for larger loans or companies not qualifying for SBA programs.

Critical Questions on Equipment Loans

How hard is it to qualify for an equipment loan?

The equipment itself often acts as collateral, so equipment loans may be easier to obtain than traditional commercial loans that require real estate or receivables. We look at your business’s viability and the equipment’s essential nature. The equipment loan approval process is generally straightforward if it makes sense for your operations, has a valuable life that matches the loan term, and improves productivity.

What credit score is needed?

Each application is different. Our underwriters look at your financial profile, not just your credit scores.

What loan terms are available?

Loan terms are structured around the expected useful life of the financed equipment. We match the term to your needs – longer terms have lower monthly payments, while shorter terms cost less overall.

What types of equipment can be financed?

We finance all types of equipment– manufacturing machines, healthcare technology, agriculture equipment, trucks, technology, phone systems, and more. If it’s essential for your business operations, we can help you find financing.

Tailored Equipment Financing

Here are a few examples of the specialized equipment loans and financing options we offer tailored to specific industries:

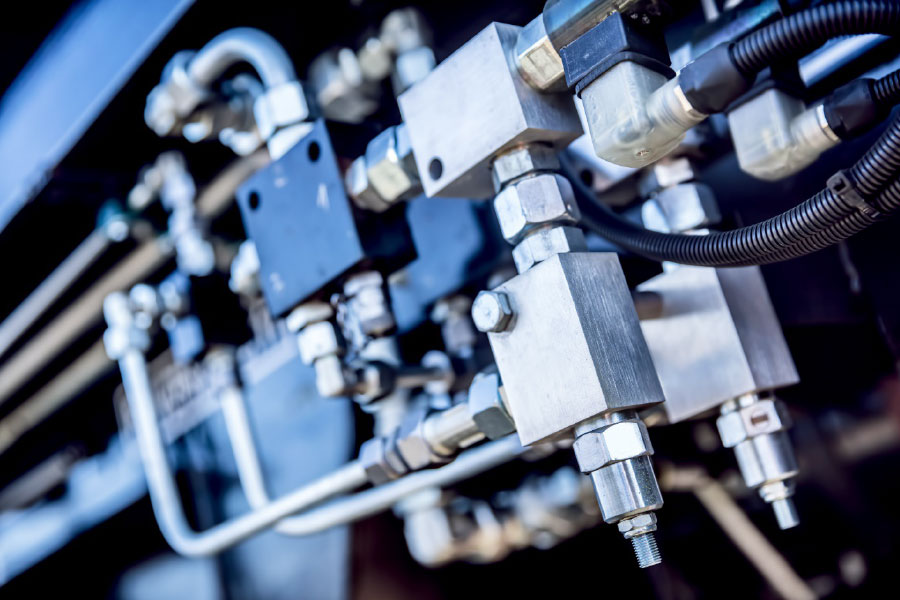

Manufacturing Equipment

For metal product fabricators, food and beverage producers, plastics plants, and other manufacturers, we finance equipment like:

- CNC machines

- Industrial printers

- Robotic arms

- Conveyor systems

- Mixers, mills, churners

- Boilers, compressors, generators

- Packaging lines

- Plastics molding equipment

- Machinery tools – lathes, presses, drills

- 3D printing equipment

- Automated guided vehicles (AGVs)

Technology Equipment

For software companies, IT firms, and other tech-enabled businesses, we fund:

- Servers & data storage

- Laptops, desktops, tablets

- Phone systems

- Surveillance systems

- Telecom equipment

- Audiovisual equipment

- Broadband network equipment

- Security and firewall systems

- Software licenses

- Tech implementation and integration

Transportation Equipment

For trucking companies, freight operations, and other transportation firms, we finance:

- Fleet vehicles

- Refrigerated trucks

- Forklifts

- Railroad engines and cars

- Buses, RVs, limos

- Aircraft, boats

- GPS tracking systems

- Onboard computers

- Safety systems

- Transportation depot construction

- Fueling stations

Healthcare Equipment

For hospitals, clinics, dental offices, and healthcare practices, we fund essential technology:

- Imaging systems – MRI, CT, Ultrasound

- Lasers and cosmetic surgery equipment

- Telehealth equipment

- Medical robots

- Patient monitoring systems

- X-ray machines

- Dental chairs and tools

- Sterilization equipment

- Microscopes and analyzers

- Patient lifts and beds

- Software systems

Agriculture Equipment

For farmers, ranchers, and dairy producers, we finance:

- Tractors, harvesters, tillers

- Irrigation pivots

- Milking equipment

- Hay tools

- Animal housing structures

- Crop processing equipment

- Trucks, trailers, loaders

- Farm management software

- Greenhouses, nurseries

- Food safety equipment

- Refrigeration systems

Our team understands the unique equipment financing needs of business owners in your industry. We craft custom solutions that allow you to acquire the technology that will take your company to the next level.

Whether you need a few thousand dollars for an essential piece of equipment or millions for a complete factory upgrade, Sunwest Bank has the lending capacity and expertise to help your business ambitions become reality.

Equipment Financing for Any Business

From restaurants to retailers, professional firms to manufacturers, virtually every company needs equipment. As your trusted financing partner, Sunwest Bank funds:

Retail Equipment

- Point of sale (POS) systems

- Self-checkout kiosks

- Shelving, racks, display cases

- Barcode scanners

- Signage and displays

- Surveillance cameras

- Forklifts and pallet jacks

Medical Equipment

- Exam tables

- Diagnostic equipment

- Sterilization gear

- Dental chairs

- X-ray machines

- Patient screeners

- Telehealth carts

- Record management software

Professional Office Equipment and Office Furniture

- Desktop computers

- Laptops

- Printers

- Phone systems

- Copiers

- Audiovisual gear

- Surveillance equipment

- Cybersecurity software

- Video conferencing tech

Streamlined Equipment Financing Process

Our simple equipment finance process makes it easy to invest in your business.

Step 1: Equipment Financing Application

Complete our quick online application detailing your business, financing needs, and equipment specifications. One of our financing experts will contact you to discuss options.

Step 2: Review

We’ll review your application and request additional documents (financial statements, business plan, etc.) to underwrite your request.

Step 3: Quote

Within days of receiving your complete information, we will provide a competitive equipment loan quote detailing estimated payments, rates, terms, and fees.

Step 4: Acceptance

Accept the financing offer and provide any extra documentation required. We can have loan documents ready immediately.

Step 5: Funding

We will finalize the loan underwriting and submit it for fast approval upon acceptance. Upon approval, equipment loan funds are disbursed directly to you or the equipment vendor.

Our streamlined equipment loan process is designed for speed and ease from application to funding. We’re committed to delivering flexible options and responsive service to equip your business for growth.

Equipment Financing Partnership

When you need capital to purchase business-essential equipment – don’t go at it alone. Partner with a financial institution that understands your industry, appreciates large and small business owner’s unique needs, and can craft flexible financing options for equipment acquisition. Sunwest Bank has supported the equipment financing needs of the Western United States and Florida businesses for 50+ years. Our experienced team offers:

- Competitive interest rates

- Custom loan terms and structures

- Fast turnaround and closing

- Responsive, collaborative service

Frequently Asked Equipment Financing Questions

Interested in an equipment loan but still have some questions? Here we answer some of the most common equipment financing FAQs:

Are equipment loans more accessible to get than other financing?

Often, yes. With equipment loans, the equipment itself usually acts as collateral. So long as the equipment is essential for your business operations, equipment financing is generally more accessible than other loans requiring real estate assets or receivables as collateral.

What credit score is needed to qualify?

Each application is different. Our underwriters look at your financial profile, not just your credit scores.

How long does equipment loan approval take?

Our streamlined approval processes deliver business loan decisions fast once we have your complete application and documentation. Having your financial records ready speeds things along.

What percentage of a down payment is typical?

Down payments on equipment loans generally range from 10% to 30% of the equipment’s purchase price. We can offer flexibility for lower down payments, primarily through SBA loan programs.

What loan terms are available for equipment financing?

Loan terms usually range from 2-10 years for equipment financing. We match the term length to the expected useful lifespan of the equipment.

What types of equipment can you finance?

We finance all types of new and pre-owned equipment across all industries – manufacturing machines, healthcare tech, trucks and fleet vehicles, agricultural equipment, IT servers and computers, construction equipment, and more.

Are there tax benefits for equipment financing?

Yes, the interest portion of equipment loan payments may be tax deductible as a business expense. This is often why a business owner will choose to buy rather than rent equipment. Consult your accountant about potential tax benefits.